The Japanese yen is weaker after a GDP miss.

The currency is down by 0.6% at 113.91 per dollar as of 8:46 a.m. ET.

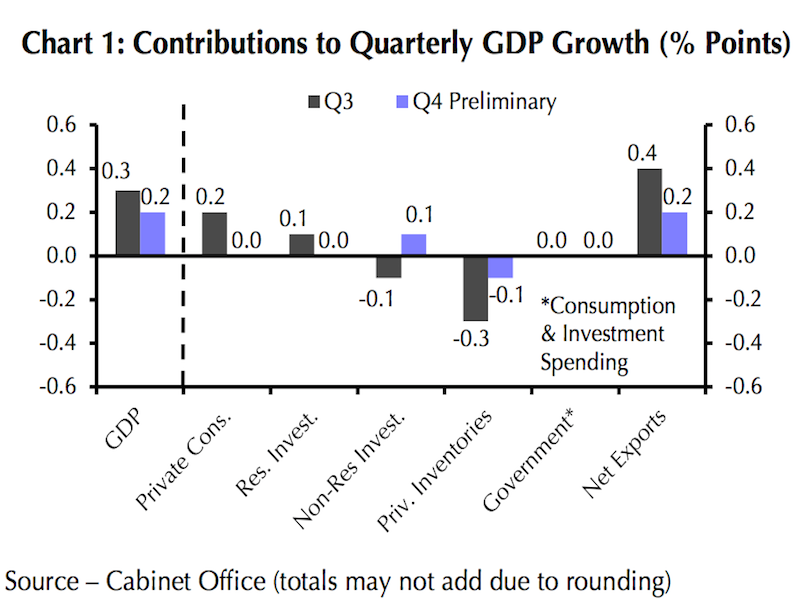

Earlier, a preliminary estimate showed that the Japanese economy grew by 0.2% in the fourth quarter, below economists’ expectations of 0.3%. This was the third consecutive quarter that growth slowed.

“Growth was not fast enough last quarter to reduce spare capacity any further, but the current level of the output gap remains consistent with stronger price pressures. The upshot is that monetary policy will remain on hold for a long time,” wrote Marcel Thieliant, senior Japan economist at Capital Economics, in a note.

“Looking ahead, the current strength in labour income suggests that consumer spending will start to recover again soon,” he added. “However, we expect the yen to weaken further towards 130 by the end of this year, which will result in a surge in prices of imported goods and undermine households’ purchasing power. We therefore expect private consumption to slow again next year.”

As for the rest of the world, here's the scoreboard as of 8:55 a.m. ET:

- The Russian ruble is up by 0.4% at 57.9930 per dollar, while Brent crude oil, the international benchmark, is down by 1.0% at $56.13 per barrel. The US dollar index is little changed at 100.90 ahead of a quiet data day. Consumer-price-index revisions will be announced. The euro is down by 0.2% at 1.0623 against the dollar. The British pound is up by 0.2% at 1.2513 against the dollar.